From Cornwall Insight Australia’s Energy Market Perspective

Our quarterly Energy Market Perspective contains an analysis of indicative capacity at REZ zones throughout the NEM. The following assessment for NSW is from our latest edition.

Request Energy Market Perspective call back

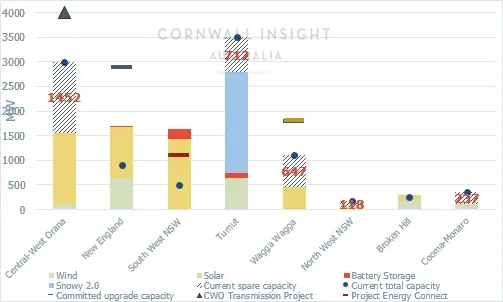

The strategic development of Renewable Energy Zones (REZs) in New South Wales (NSW) is currently focused on three key areas: Central West Orana (CWO), New England, and Southwest. These regions are anticipated to serve as hubs for substantial growth in renewable energy, accompanied by extensive network expansion in the coming years.

CWO takes centre stage in the NSW Government’s REZ rollout, featuring numerous proposed generators, albeit uncertain about the likelihood of all projects proceeding. In the face of challenges in other regions to secure available capacity, CWO emerges as a primary option until additional augmentation measures are implemented. Establishing a 500kV ring is poised to enhance the security of Sydney’s energy supply, creating diverse routes from collector points at Wollar. EnergyCo’s ambitious proposal includes an initial stage with 4.5GW capacity, which is expected to be commissioned and operational by 2027/28.

Additionally, with the commitment to Project EnergyConnect, some capacity in the South West REZ will become available, while contributions from KerangLink and Hume Link are anticipated to contribute to increased capacity. Despite facing current capacity constraints and system strength issues, ongoing upgrades are actively addressing these challenges in the Southwest.

In New England, an oversupply of generated energy has led to the inclusion of a transmission link in the 2022 Integrated System Plan (ISP) with an intended capacity of 8GW. Despite private proposals, actual transmission projects have yet to commence in the area. Furthermore, the construction of Hume Link holds the potential to unlock a significant capacity in Wagga Wagga.

Meanwhile, endowed with abundant solar resources, Broken Hill encounters grid connectivity challenges with a single line to the Buronga area in the West Murray Zone. Presently, a Regulatory Investment Test for Transmission (RIT-T) is underway by Transgrid, exploring augmentation options to replace diesel turbine backup generators. Non-network alternatives, including storage solutions in Broken Hill, are actively under consideration.

NSW REZ outlook (indicative)