The Step Change scenario in the 2022 Integrated System Plan (ISP) is targeting 83% renewable energy generation in the NEM by 2030-31. By then, around 79GW of VRE resources (wind, utility solar, and distributed PV) is expected to have been installed to help replace the 14GW capacity of synchronous generation withdrawn.

Increased generation from VRE resources and a decrease in synchronous generation installed will result in the reduction of system inertia. System inertia is the ability of synchronous generators to resist frequency changes by virtue of their rotating mass. The lower the system inertia, the faster the frequency deviation is after a contingency event, such as a power station unexpectedly going offline. Primary frequency response and contingency ancillary raise services may help arrest the frequency during such events. However, with higher Rate of Change of Frequency (RoCoF) thresholds, there is less time for PFR to respond, leaving contingency raise services to pick up the slack.

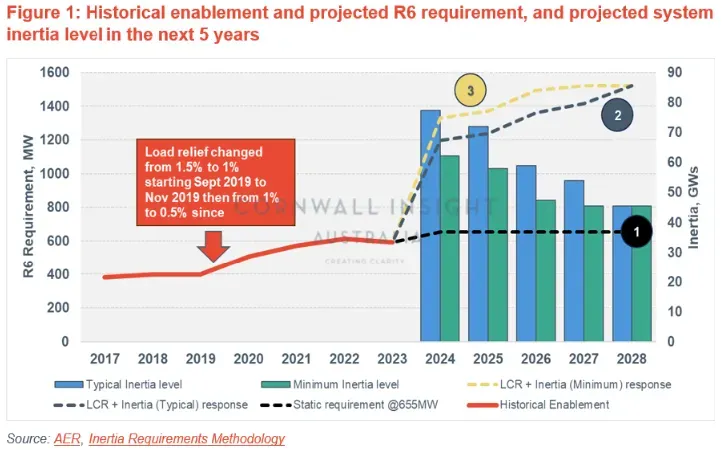

In this Chart of the Week, we examine the effect of a decrease in system inertia and the amount of contingency raise service, specifically Raise 6-second (R6), that may be needed for frequency restoration.

Source: AER, Inertia Requirements Methodology

Figure 1 shows an increasing trend in R6 enablement starting in 2019-20. This increase, however, is not due to a decrease in inertia levels but is due to a stepping down in load relief from 1.5% to its current value of 0.5%. Load relief is the assumed change in load that happens when system frequency changes. Also shown in Figure 1 are three scenarios of projected R6 requirements, with these general assumptions; the Largest Credible Risk (LCR) will be set by Kogan Creek and low load conditions of 18,860 MW.

| Scenario | Description | Method to calculate R6 requirement |

|---|---|---|

| 1 | Business as usual | R6 requirement based on LCR and load relief |

| 2 | LCR + Inertia (Typical) response | R6 requirement will consider decrease in typical and minimum threshold inertia levels. First, the projected system inertia level was estimated based on typical sub-region inertia values and projected based on the trend of decreasing sub-region inertia levelsuntil 45,350 MWs. From then, the projected inertia referenced R6 requirement will be calculated. |

| 3 | LCR + Inertia (Minimum) response |

Under scenario 1, a static requirement of 655MW, LCR & 0.5% Load Relief may not be sufficient to restore the system to a frequency level acceptable to the Frequency Operating Standard. In order to solve this problem, the relationship between R6 requirement and system inertia levels was used to project future R6 requirements for scenarios 2 and 3. For the years 2023-2024, the R6 requirement is set at 1,195MW for scenario 2 and 1,328MW for scenario 3, already double that of static requirement, and continues to increase to 1,519MW by 2027-28.

While increasing the contingency raise service can help restore frequency in cases of low inertia level, it may not be economical to increase the requirement to more than double the current enablement levels. The upcoming Very Fast FCAS market, which will commence on 9 October 2023, is expected to alleviate the potential increase in R6 requirement brought about by low system inertia conditions. Synchronous generators that provide physical inertia and synchronous condensers with flywheels can also be alternative ways to deal with low system inertia conditions.

Cornwall Insight Australia has an in-house FCAS forecast model that considers these potential scenarios. Our model is based on engineering techniques and assumptions, leveraging our extensive experience, comprehensive research, and independent perspective on relevant areas. For more information on power and market modelling or other consultancy products, please contact enquiries@cornwall-insight.com.au.