The Federal Government has legislated emissions reductions of 43% below 2005 levels by 2030. Sourcing electricity from renewable technologies is fundamental to meeting this, with a much-publicised target of 82% renewables in the grid by 2030 – up from a current value of 38% over the last year. Fortunately, the 2022 Integrated System Plan (ISP) from the AEMO provides a guide to get there.

Unsurprisingly, a significant buildout of variable renewable energy (solar and wind) will be required to reach the 82% by 2030 target. The ISP has a VRE installed capacity requirement of 44GW by 2030, requiring 23GW of VRE to be installed over the next 6 years[1], or roughly 4GW of VRE annually from now to 2030.

To date, the VRE buildout has (roughly) seen equal growth of utility-scale solar and wind (9GW solar and 11GW wind) in the NEM. Assuming a similar growth profile for the two technologies would mean around 2GW of solar needs to be built year on year over the next 6 years. For context, over the last 5 years in the NEM, utility-scale solar has been added at an annual average annual rate of 1.2GW.

Despite this step change in utility solar investment required over the next 6 years, it is becoming increasingly difficult to envisage that, given the current policy settings, these targets will be met. Some current headwinds to utility solar investment include:

- The proliferation of residential PV that is not exposed to wholesale spot prices,

- Government support for coal-fired generation,

- The end of the LRET in 2030,

- Increasing curtailment and a lack of certainty around network infrastructure,

- Uncertainty around whether generation-weighted plus LGC prices are sufficient to cover the costs to build and operate utility-scale solar.

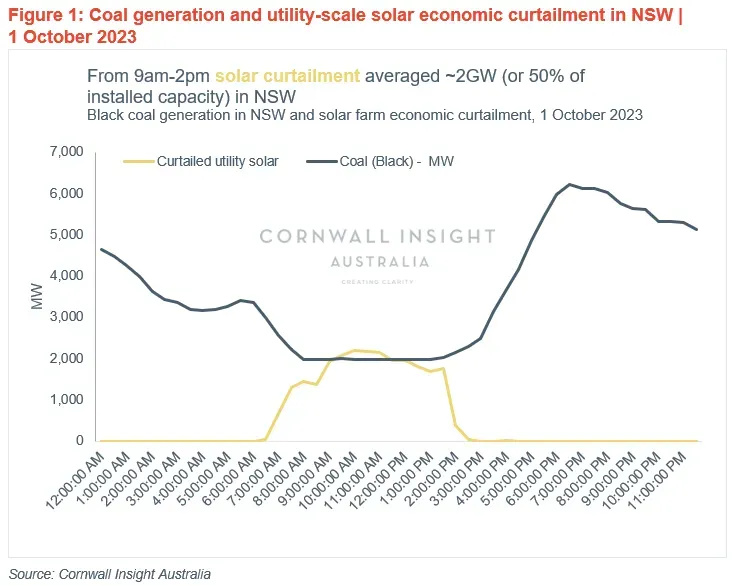

This Chart of the week highlights the current issues facing utility solar investment in the NEM by looking at the generation outcomes in NSW on Sunday, 1 October. The chart shows the volume of utility-scale solar that was self-curtailed due to the wholesale price available being below the price the solar farm can break even (on a wholesale price plus large-scale generation certificate price basis). Between 9am-2pm around 2GW, or half of the NSW’s utility-solar capacity, was self-curtailed. Interestingly, this was also the minimum generation volume of the NSW’s black coal assets throughout the day which are required to continue operating at a minimum available capacity to meet the evening peak.

The results above are not an isolated event, with a third of solar generation for the month of September exposed to negative prices. This will be exacerbated by the continued march of rooftop solar, which is forecast to add another 4.5GW over the next 6 years[2] in NSW. To be clear, some curtailment is to be expected as the NEM transitions to the target of 82% renewables, as there will have to be enough renewable generation through the winter months to meet targets.

However, if across the NEM to 2030, around 2GW per year of utility-scale solar is required and 2.1GW of rooftop solar is forecast, it seems likely that the market will be oversupplied more often over the coming years[3].

Whilst extending the RET is an option to improve the economics of utility-scale solar and is being promoted within the industry (Extend the RET)), the position of the NSW Government to subsidise the extension of coal generation is also a decision that will do nothing to improve the economics of utility-scale solar as illustrated in the chart above.

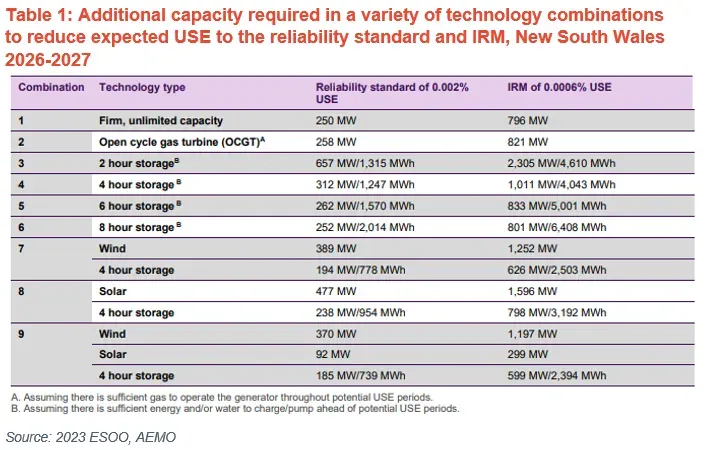

In the 2023 ESOO, AEMO outlined several combinations of dispatchable capacity that would result in sufficient capacity across all the scenarios modelled. These are outlined in the table below:

If the purported figure of $3b to extend Eraring’s retirement date by two years is accurate, then the NSW Government should be considering if any of the combinations above might be a more efficient use of money, particularly as the investments will remain available for a duration greater than two years. In addition, the prolonged presence of coal generation and the lower daytime prices that are a consequence also increase the risk in NSW that the LTESA contract options will be triggered by investors, which will mean NSW customers are paying for both the extension of Eraring and the topping up of solar contracts due to periods of low prices.

Speculatively, a combination of utility-scale and residential two-hour BESS (2,305MW in total) installed at $1,300/kW would result in the same total costs as the Eraring extension whilst still meeting the stringent Interim Reliability Measure and adding daytime load to the system to support daytime solar prices.

Focusing on residential battery uptake in particular would also resolve a number of the risks AEMO have highlighted in the 2023 ESOO, such as:

- Severe weather or power system events that result in prolonged transmission network unavailability.

- Periods of large generation unavailability, including planned and unplanned outages.

- Delays to the commissioning of new transmission, generation or storage capacity.

- Operational impacts of extreme temperature on all generation technologies that may reduce output to below the rated generator capacity.

- Periods of low minimum demand that risk the security of the power system.

Using numbers from the 2023 IASR, an additional 800MW of residential storage is expected from FY24 to FY27. With a $3b push and given the success of subsidies in turbo-charging rooftop PV, it seems a missed opportunity to rely on the residential battery market to grow organically when an escalation of residential battery capacity could reduce many of the issues facing the grid throughout the transition. Increasing daytime load would also support the continued integration of utility-scale variable renewable energy in the grid.

[1] Using a current estimate of 21GW capacity for solar and wind (operating and committed) from https://opennem.org.au/

[2] 2023 IASR assumptions workbook, AEMO

[3] Vales Point Power Station closure date has been pushed to 2033 which means Eraring is the only expected coal retirement before 2030