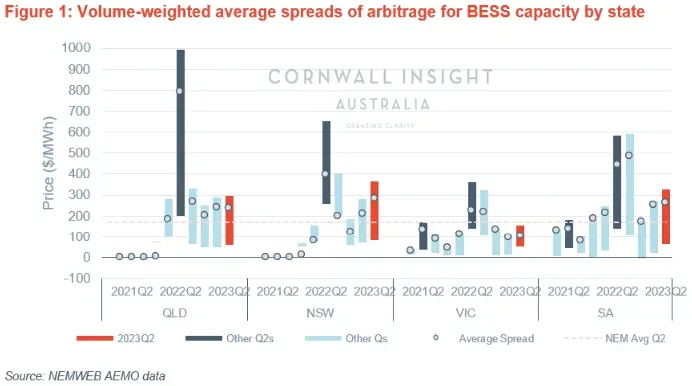

The focus of batteries is constantly adjusting to reflect ‘where the money is at’. Various quarters have trends, and others have events that swing momentum. With FCAS enablement in Q2 this year dropping to some of the lowest values since 2016, shifting the solar curve, or rather arbitrage, became the biggest focus for storage assets. Volume-weighted average spreads sat at $170/MWh for large-scale storage assets on the mainland, the second highest revenue spread since battery additions in the NEM (with last year’s spread an all-time high of $327/MWh for reference). Within this, a notable 53% of these battery revenues were directed towards dispatch within the energy market, which is not far off the 63% of battery revenues from the energy market from the same quarter last year leading to the market suspension.

In this Chart of the week, we look at the volume-weighted average spreads from the last two years of currently operating batteries around the NEM and discuss how these batteries have faired over recent history in the ‘value’ of shifting the solar curve.

Some quick notes about the graph:

- The chart is solely based on energy markets and includes no FCAS enablement values

- The graph includes all data for active storage DUIDS (including those that may have been in commissioning)

- The top of the bar is the average VWAP of generation DUIDs for each state, and the bottom of the bar is the average VWAP of charging DUIDS.

- Values do not include any loss factors.

Diving into the data, volume-weighted average charge values sat at $57/MWh, with dispatch at $227/MWh, seeing a spread (or arbitrage value) of $170/MWh. This variance is what really matters, showing that although many consider summer volatile prices to provide the upside, there is still value during the down months, especially as NEM prices drop back to pre-2022 levels. On a state basis, charging VWAPs sat at $58/MWh in QLD, $81/MWh for NSW, $50/MWh for VIC, and $65/MWh in SA, with dispatch having $297/MWh in QLD, $364/MWh for NSW, $153/MWh for VIC, and $328/MWh in SA.

With volatility in the south up as well as 13% and 17% of intervals in VIC and SA falling negative in Q2, the high charging values do seem slightly disappointing in these states, where it’s clear that high VRE and rooftop PV throughout the day are driving the negative trends and provide a perfect opportunity to charge. There may be room for improved spreads in the future.

A large part of the arbitrage revenues and costs occurred across the first week of April, with market events in NSW (3 April) and across all four states (5 April) seeing high prices across the board. Walgrove, Wandoan, VBB, and Hornsdale were all charging at high-priced intervals pre-peak time to capitalise on spreads – a sign of a solid operating system doing its job.

With buildout seemingly behind schedule, it’s unlikely that batteries will be able to play any significant role in price-setting dynamics in the NEM due to their limited capacity. Instead, the hydro and thermal sectors are poised to maintain market control in peak times. As maximum demand increases while minimum demand recedes, it’s highly probable that arbitrage spreads will persist as a primary catalyst for revenue generation within the realm of storage assets.

Ultimately, battery operators must determine how to approach each of these issues and chart their path to maximise their returns on investment for their battery project. Our Storage Profitability Benchmark Report provides an in-depth focus on current storage operations and forecasted potential revenues. For more information, please contact enquiries@cornwall-insight.com.au.