On 9 October 2023, 1pm (market time), we saw the start of two new contingency FCAS markets. The Very fast raise contingency FCAS market, and the Very fast lower contingency FCAS. Upon commencement of the VF FCAS market, a commissioning period of two weeks with an initial max requirement of 50 MW for both Raise and Lower 1s service will be used to establish market operations and to allow AEMO to react if any issue arises.

In this Chart of the week, we take a quick look at the performance over its first three days (October 9-11) and provide a brief outlook of how the bids are stacking up.

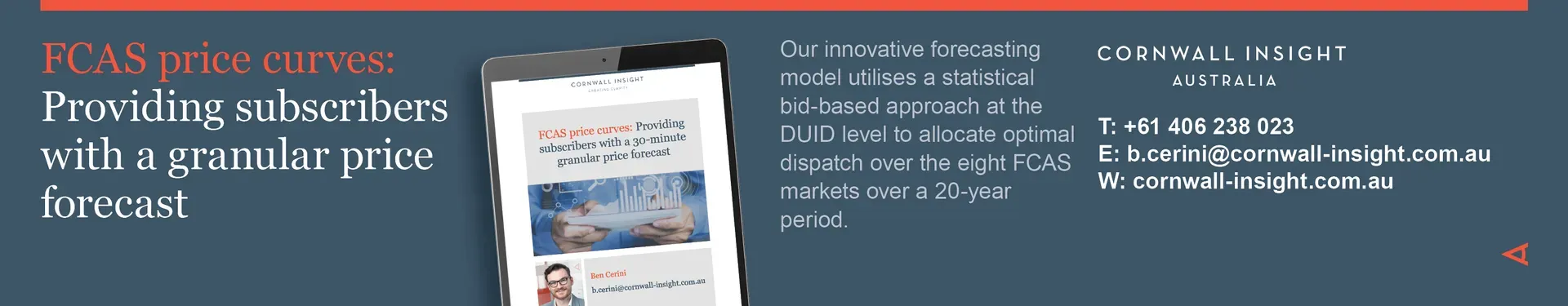

Six registered batteries currently look to have control of the market, with the VIC Big Battery and Hornsdale Power Reserve providing the bulk and Walgrove, Queanbeyan, Lake Bonney, and Bulgana batteries also registered. A few other DER and VPP small participants (YES, Enel and Viotas) have their hats in the ring and are playing roles in the markets (mostly the R1 market with only ~3MW bid into L1).

Currently, 567 and 448 MW are registered in R1 and L1, much less than this bidding at a reasonable volume. It is a surprise given that many expected it would provide up to 300 MW of enablement by the end of the year and up to 500 MW in the future.

The first surprise we’ve seen with the introduction of the market is that there are only 16 unique assets registered, compared with the ~40 batteries, VPPs and DER assets we have in the 6-second market. Whether various batteries are simply delayed in registration, can’t handle the 1-second conditions, or have no interest in competing in the market, only time will tell. To recap, it is a requirement that the facility must be able to deliver the enabled amount of power in 1 second and maintain it until the 6-second (fast FCAS) kicks in, and this will likely be extremely hard from the outside looking to determine what BESS’ cannot do this.

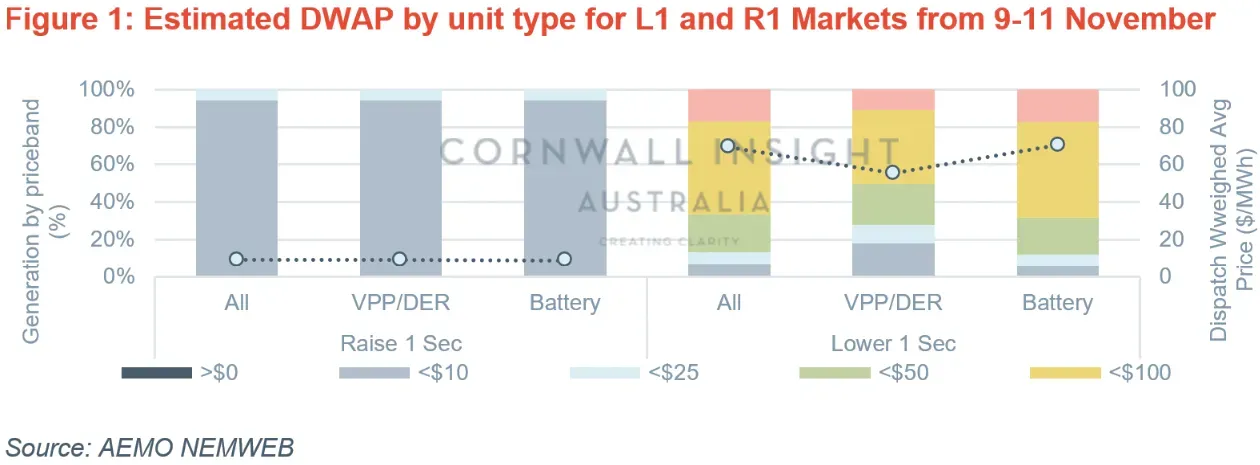

The levels are dynamic, reflecting, at times, the need for adjusting requirement levels as power system conditions change. We can see this in the Lower 1 Sec requirement changes, operating at ~25MW on average. While the Raise 1 Sec requirement stays steady at 50 MW. The second noticeable outcome of the market so far. This seems to be a case of two reasons, which will need more time to lean on one. AEMO currently seems reliant on protecting against a generation shortfall, and the R6 demand is relatively higher than the L6 demand, affecting the ratio calculation for L1.

Source: AEMO NEMWEB

Source: AEMO NEMWEB

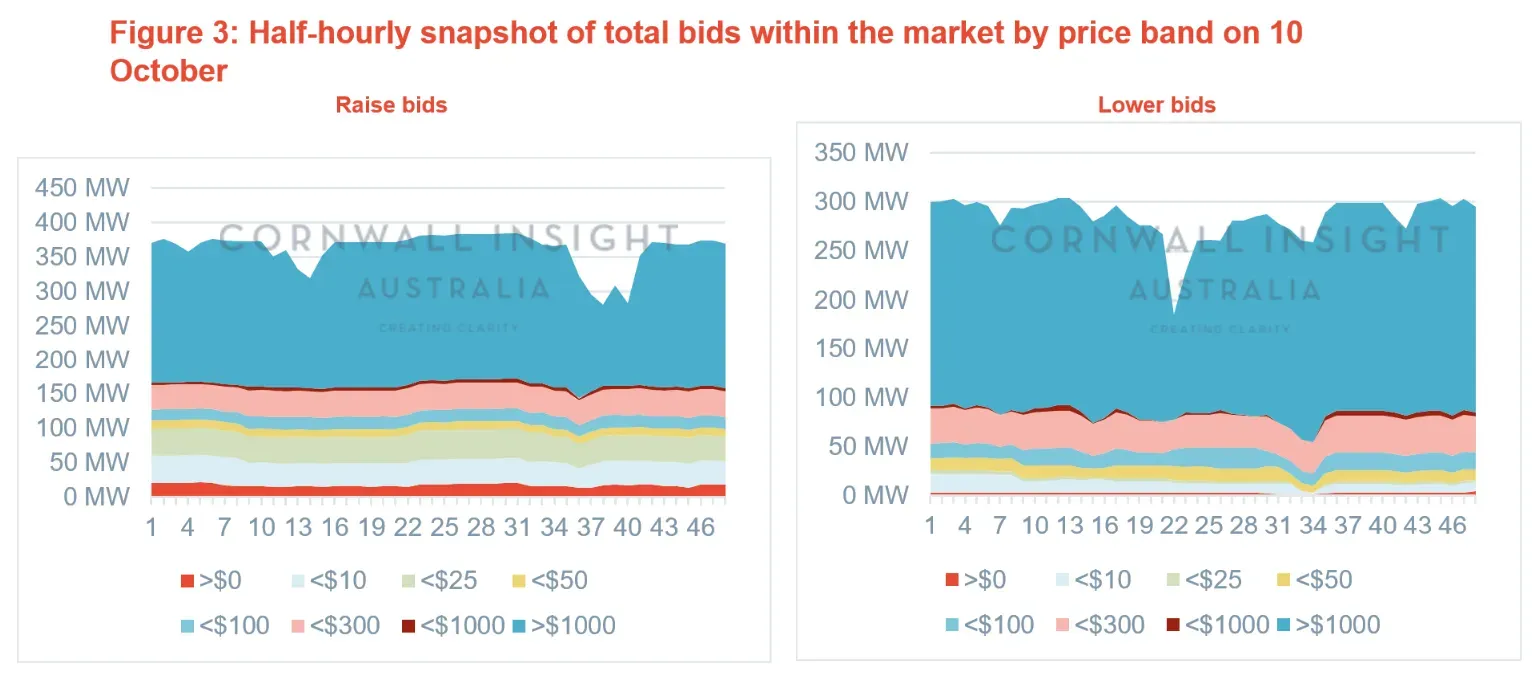

The third surprise is how much availability has been bid into top price bands. Although this might come down to knowledge of the 50 MW maximum and not wanting to drive down prices and leave capacity to be used elsewhere, it is making a difference in pricing outcomes on the lower side. With only ~45 MW bid into typically competitive contingency price bands, those paying attention to prices would have noticed the consistent fluctuations in high pricing. (a value reflected in Figure 1 dispatch numbers). With only 80 MW bid under $300/MWh, the consistent raises expected to be introduced by AEMO in two weeks may not be a positive outcome for generators and their contingency costs. Given that it has only been three days of operations, these bidding outcomes should be expected to change as the market adjusts. However, with lower revenues currently sitting at $69/MWh of enablement, operators are likely to focus some attention here.

In saying all of the above, we will have to wait sometime before we draw any trends and probably even before moving to an initial estimate of 300 MW. As mentioned in our COTW two weeks ago, AEMO is currently setting out fortnightly increases in VF FCAS requirements from the initial 50MW requirement and progressively increasing it to allowed requirement volumes depending on the level of registered capacity and participants’ committed participation in the VF FCAS services. This latter capacity seems to be off to a slow start, given that we have over 1.5GW of BESS in the NEM and only a medium amount of that registered in this market, with a few big batteries missing.

Cornwall Insight has an in-house FCAS forecast model, and our next release will include the new VF FCAS markets with forecast prices for a 20-year horizon. Our model is based on engineering techniques and assumptions, leveraging our extensive experience, comprehensive research, and independent perspective on relevant areas. For information on power and market modelling or other insight services, please contact enquiries@cornwall-insight.com.au.