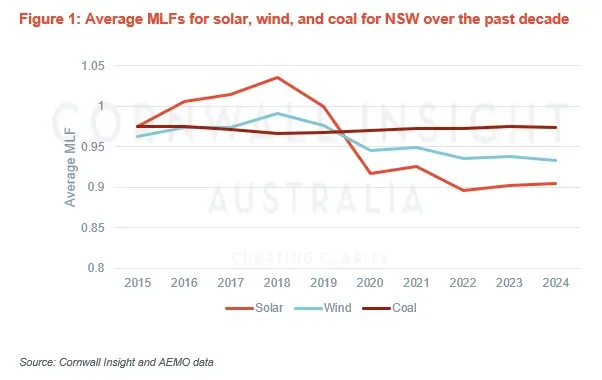

MLF, short for Marginal Loss Factor, represents the portion of electricity losses that occur along the transmission network between a connection point and the Regional Reference Node (RRN). Within the NEM, the MLF serves as a metric to quantify these losses along the network, playing a pivotal role in determining market settlements, meaning the impact of MLFs on electricity generator revenue cannot be overstated. In this edition of our Chart of the week, we take a closer look at how Marginal Loss Factors in New South Wales (NSW) have evolved over the past decade.

As observed in Figure 1, utility-scale solar MLFs have shown the highest degree of variance over the past decade. Throughout this period, NSW solar MLFs have fluctuated from a high of 1.036 in 2018 to a low of 0.895 in 2022. Notably, there was a significant decline in the average MLF from 2018 to 2020 within this region. During these two years, several solar farms, including Capital East Solar Farm, Royalla Solar Farm, and Mugga Lane Solar Farm, experienced a decrease of approximately 6-7% in their MLFs. Similarly, Moree and Gullen Range solar farms observed a 3% drop in their MLFs during the same period. Notably, among these, Moree solar farm maintains the lowest MLF within the NEM, with a registered MLF of 0.7977.

The primary driver behind the decline from 2018 to 2020 can be attributed to the substantial increase in Variable Renewable Energy (VRE) generation during those two years. During this period, more than 25 newly connected solar farms came online from 2018 onwards, significantly influencing the MLF values associated with solar farms. This influx of solar energy generation during daylight hours served to lower MLF values. One of the solar farms most significantly affected by this decline was the Broken Hill Solar Farm, which saw a substantial 40% decrease over those two years from the connection of about 1GW of solar at the other end of the transmission line closer to the primary load.

In comparison, wind MLFs exhibit less fluctuation compared to solar, yet they do not maintain the consistency of coal. This pattern aligns with the availability of wind generation throughout the day and its intermittent nature. Consequently, wind power is generated during the evening and early morning hours, where less competition means lower losses, leading to higher MLFs. However, it is worth noting that the wind farm facing the most significant challenges in NSW is the Silverton wind farm near the Broken Hill area (1.0062 in 2019 to 0.7973 in 2023), primarily for reasons like Broken Hill solar mentioned above. Additionally, the White Rock wind farm also recorded a relatively low MLF value of 0.8289 in 2023 due to high flows from Queensland. Nevertheless, aside from these specific cases, wind farms in the region have generally maintained reasonably good MLFs over the past decade.

Forecasting Marginal Loss Factors (MLFs) is crucial for new power generators entering the National Electricity Market (NEM). Our in-house power system analysis and market modelling provide MLF forecasting based on sound engineering techniques and assumptions derived from our vast experience, comprehensive research, and independent view of relevant areas. For more information on power system analysis or other modelling products, please contact enquiries@cornwall-insight.com.au.