"While the forecasted reductions from April offer some hope, they remain well above historical norms and do little to alleviate the immediate pressure on consumers this winter."

Dr Craig Lowrey Principal Consultant

THESE FIGURES ARE NOW OUT OF DATE AND DO NOT REFLECT THE CURRENT MARKET CONDITIONS - NEW FORECASTS WILL BE RELEASED IN THE NEXT FEW DAYS.

Ofgem has today announced the January-March 2025 Default Tariff Cap (price cap) at £1,738 a year for a typical dual fuel consumer1. This is a 1.2% increase from October’s cap set at an annual rate of £1,717. Wholesale price rises, due to geopolitical tensions, global supply pressures and winter weather conditions, have been cited as the key reason for the increase in bills.

New forecasts from Cornwall Insight for later in the year, do however bring more positive news, with bills predicted to reduce slightly by 1.4% in April falling to £1,713 per year for a typical dual fuel user, before dipping slightly again in July. While the predicted fall in bills later in the year will be welcomed, this will be of little comfort to households struggling with energy costs this winter.

At the same time, April's forecasts also remain significantly above historic norms, reflecting a wholesale energy market – and therefore energy bills – still susceptible to international shocks. These have been in the form of direct supply problems, as well as political events such as the results of the recent US presidential election and its impact on global supply chains for renewable technologies.

Indeed, the UK’s dependence on international gas markets in particular represents a key source of uncertainty which could lead to adjustments in April's price cap forecasts. The full impact of these developments remains uncertain.

The rise in bills yet again will no doubt reignite calls for the price cap to be reformed. Ofgem is currently undertaking a comprehensive review of the cap as part of its assessment of general consumer protection measures, and we await the findings.

News this week of energy suppliers committing £500m to support vulnerable customers with their bills this winter is a welcome step. The government's plans to support investment in pursuit of the net zero transition and lower bills in the long-term need to be complemented by measures to help households now, such as the introduction of social tariffs which could provide sustained support for those most at risk.

Figure 1: Cornwall Insight’s Default Tariff Cap forecast using new Typical Domestic Consumption Values (dual fuel, direct debit customer)

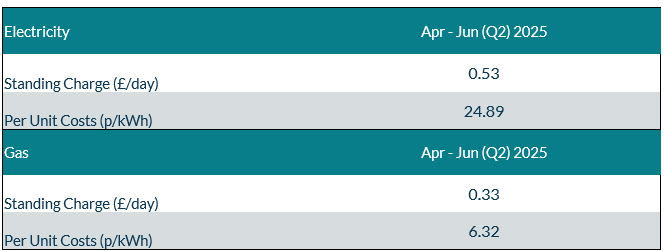

Figure 2: Default Tariff Cap forecast, Per Unit Costs and Standing Charge (dual fuel, direct debit customer)

Source: Cornwall Insight

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

This latest increase in the price cap underlines the continuing volatility of the energy market, which is still experiencing the lingering effects of the energy crisis. While the forecasted reductions from April offer some hope, they remain well above historical norms and do little to alleviate the immediate pressure on consumers this winter.

There’s little point in waiting for the market to settle on its own - there’s no going back to so-called ‘normal’ prices, unfortunately, this is the new reality. Any reform of the price cap will be just one piece of the solution – what’s urgently needed is a comprehensive approach, including targeted support such as social tariffs and sustained investment in domestic renewable energy sources, to help shield consumers from ongoing market shocks.

Reference:

- Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.