New forecasts from Cornwall Insight predict a typical dual fuel consumer’s1 energy bill will fall to £1,683 from July. This would represent a drop of almost 9% on April’s £1,849 cap, with an average customer paying £166 less annual equivalent a year.

Looking ahead, we are currently forecasting a very slight fall in the price cap in October, with the cap falling again in January 2026.

The recent decline in wholesale prices has been driven by a mix of geopolitical and market developments, including the United States’ decision to introduce tariffs – and the broader impact of these – and the impact of above average temperatures, which has reduced demand expectations and eased pressure on short-term prices.

While falling prices may appear to be good news, they are also a sign of how volatile the market remains. There are many moving parts, and with the July cap still a month away from being finalised, it is too early to say whether these reductions will hold.

Several geopolitical factors could continue to influence prices. For example, US tariffs could discourage Liquified Natural Gas (LNG) exports to other countries, potentially pushing down US LNG prices. However, there's no guarantee this cheaper gas would make its way to the GB market.

At the same time, discussions in the EU around easing gas storage requirements for the coming winter could reduce injection demand and put further downward pressure on prices. However, the wider geopolitical backdrop, including the conflict in Ukraine, the uncertain nature of the tariffs and broader economic uncertainty, could just as easily push prices back up.

We expect a continued level of volatility in both prices and forecasts as markets respond to these ever-changing geopolitical, macroeconomic and supply-side dynamics.

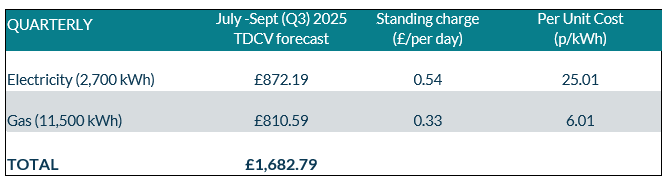

Figure 1: Cornwall Insight’s Default Tariff Cap Forecast Based on Typical Domestic Consumption, and Per Unit Costs and Standing Charge Values (dual fuel, direct debit customer)

Source: Cornwall Insight’s Default Tariff Cap Forecast Service

Note: All figures are national average unless otherwise stated. All intermediate and final calculations are rounded to two decimal places. Totals may not add due to rounding.

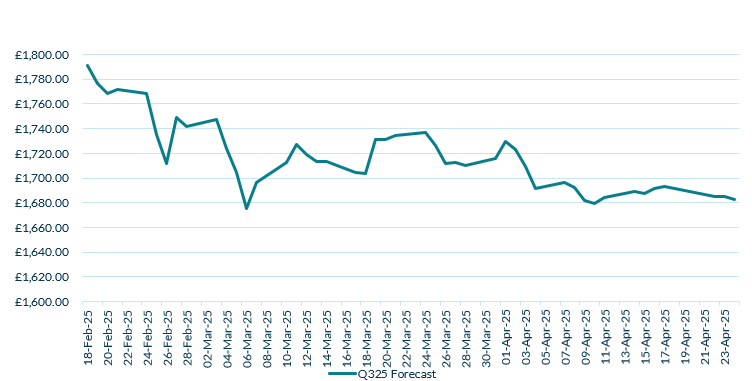

Figure 2: Q3 2025 Default Tariff Cap Daily Forecast using Typical Domestic Consumption Values (dual fuel, direct debit customer)

Source: Cornwall Insight’s Default Tariff Cap Forecast Service

Dr Craig Lowrey, Principal Consultant at Cornwall Insight:

"While a fall in bills will always be welcomed by households, we mustn’t get ahead of ourselves. We have all seen markets go up as fast as they go down, and the very fact the market dropped so quickly shows how vulnerable it to geopolitical and market shifts.

“It would be easy to conclude the fall in the market was due to the United States tariffs, but the reality is that the interactions within and across the energy market are complex - from energy storage requirements in Europe, to warmer weather, to global trade issues – and contribute to the volatility we have seen in recent weeks.

“There is unfortunately no guarantee that any fall in prices will be sustained, and there is always the risk of the market rebounding. The only real way to protect households from this constant cycle of instability and insecurity is to reduce our dependence on international wholesale markets. That means continuing to focus on growing low carbon energy generation here in Great Britain and building a more secure, more sustainable energy future.”

Reference:

- Ofgem’s Typical Domestic Consumption Values (TDCVs), are set at 2,700 kWh per annum for electricity, and 11,500 kWh per annum for gas.

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases: The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption: The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight. All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group Cornwall Insight is a leading provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Great British, Irish and Australian energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.