"If the UK is to establish itself as a true leader in EV growth, we will need to see both sustained government funding and the cultivation of a fully supportive regulatory framework."

Jamie Maule Research Analyst

Setbacks in crucial support programs like the Rapid Charging Fund, cuts to electric vehicle (EV) passenger car purchase incentives for most consumers, and a rollback of petrol and diesel phase-out targets have seen the UK drop behind much of Europe in the race to grow EV fleets.

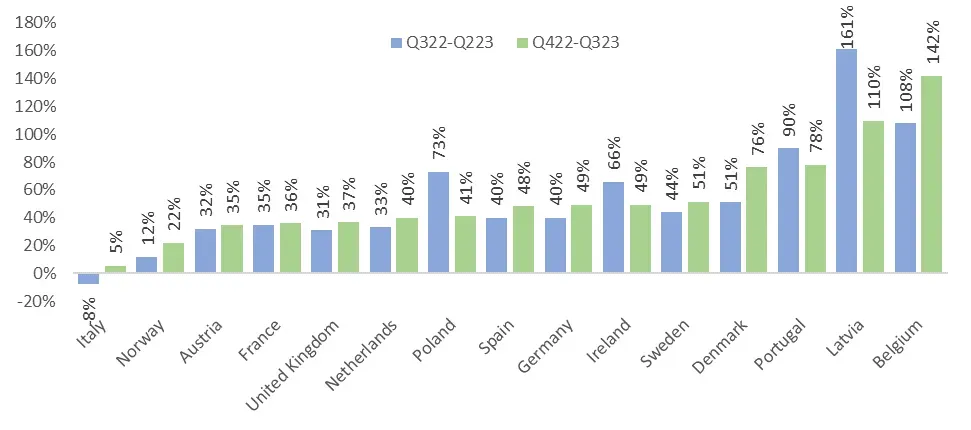

The data analysed for Cornwall Insight and law firm Shoosmiths’ Electric Vehicle Country Attractiveness (EVCA) Index,1 reveals that the UK’s battery electric vehicle (BEV) fleet experienced a slower growth of 37% in the past year, down from 42% the previous year. This places the nation significantly behind many others on the Index, especially when considering the EU’s average growth of 48% over the same period.

The results are all the more concerning with the looming threat of new trade tariffs, threatening to further discourage investment and slow down the transition to EVs.

Of particular concern is the impact of Rules of Origin Tariffs on EVs not manufactured within the EU. These tariffs could add on approximately £3,400 to EU-made EVs sold in the UK and £3,600 to British-made EVs sold in Europe.2

Discussions continue around potential delays to the implementation of the tariffs currently scheduled for January 2024, with the UK proposing a delay until 2027. When these tariffs are implemented, the cost-gap between EVs and more polluting vehicles could widen by a significant amount, as petrol and diesel vehicles will be unaffected.

It is hoped announcements made in the Autumn Statement could help to speed up growth as, alongside further support for manufacturing, the government is aiming to remove unnecessary planning constraints” and ensure that the National Planning Policy Framework prioritises the rollout of EV charge-points”. However, whenever the planned Rules of Origin tariff is implemented, EV sales in the UK are almost certain to be negatively impacted.

Figure 1 – BEV sales growth, (year-on-year change)

Source: European Automobile Manufacturers Association (ACEA)

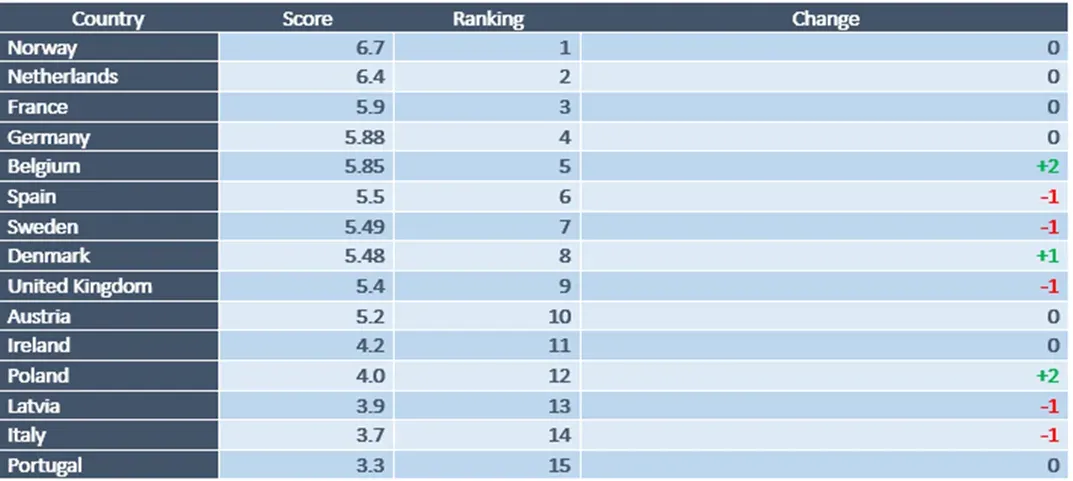

Comparatively slow growth, a roll back in petrol and diesel phase-out targets, and a lack of urgency in delivering publicly accessible charge-points have all seen the UK’s attractiveness for investment in EVs wane, with the UK dropping to 9th out of 15 major European nations in the EVCA Index.

Figure 2: EVCA Index scores and rankings

Source: Cornwall Insight

Jamie Maule, Research Analyst at Cornwall Insight said:

The government needs to implement a more consistent and holistic approach to EV support, to avoid casting a shadow over the nation’s EV industry. While EV sales continue to rise at a respectable rate, the government’s wavering commitment has created an unstable environment for investors, potentially jeopardising the development of a robust domestic supply chain and exposing potential buyers to higher costs.

The Autumn Statement’s pledge of financial and policy support offers some hope. However if the UK is to establish itself as a true leader in EV growth, we will need to see both sustained government funding and the cultivation of a fully supportive regulatory framework.

The introduction of tariffs for EVs made outside the EU would add another entry into the ‘cons’ column for investors looking at sites in the UK, and would push up prices for UK drivers buying EVs from Europe. Question marks remain over whether the EU will agree to the three year delay being touted by the UK. Without it, the UK’s EV transition faces a tougher road ahead.”

Chris Pritchett, Energy and Infrastructure Partner at Shoosmiths, said:

Policy and economic uncertainty remain a major obstacle to accelerating EV readiness, as stuttering deployment of the Rapid Charging Fund and the threat of the Rules of Origin tariffs in the UK could put the brakes on the attractiveness of new EVs.

We are encouraged, though, by positive aspects of the Autumn Statement to support UK battery manufacturing, actions on grid connections and planning but more importantly, the significant scale of EV infrastructure and energy projects our industry partners are preparing to deliver across the UK and Europe.

Alongside this, the increasing availability of second-hand and ex-fleet EVs will significantly increase the accessibility of EVs, as well as significant players such as Motability bringing EVs to a much wider range of customers and geographies. We remain very positive.”

Reference:

- The Electric Vehicle Country Attractiveness (EVCA) Index is a quarterly ranking that charts the relative attractiveness of major European nations for investment in EVs. A range of indicators, subject to differing weightings, have been utilised in the production of this index. They are listed as follows without regard to importance or weighted value:

- Committed government funding

- National EV sales targets

- National EV charge-point implementation targets

- Support for ICE vehicle rollback or ban

- Available investment subsidies, funds, and tax benefits for EVs and EV charge-points

- Available purchase subsidies, funds, and tax benefits for EVs and EV charge-points

- Ability to conduct business

- Rate of inflation

- Market share of BEVs in new registrations/sales

- Share of BEVs in the passenger car stock

- Four-quarterly growth of BEV sales

- BEVs per publicly accessible charge-point

- Charge-points per kilometre of motorway

- Four-quarterly growth of publicly accessible charge-points

- Achievement of Alternative Fuels Infrastructure Regulation (AFIR) fleet-based charge-point targets

- Wholesale cost of electricity scaled to GDP

2. Agreement with Europe needed to avoid £3,400 electric vehicle tax hike – Society of Motor Manufacturers

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.