“A move towards low-carbon energy generation such as offshore wind, with its relatively low marginal costs, is the UK’s logical path away from an energy market suffering from supply-led high and unstable prices."

Tom Edwards Senior Modeller

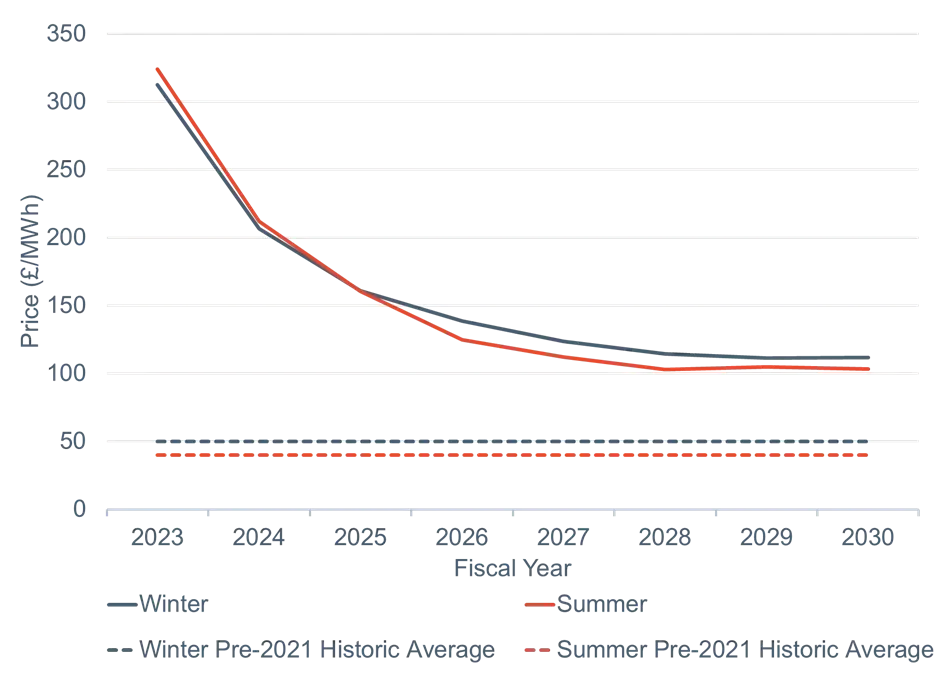

Data from Cornwall Insight included in our third 2022 – GB Power Market Outlook to 2030 – has forecast a drop in prices from late 2023, as gas prices fall from current peaks. Later in the decade, renewables play a key role in the levelling out of prices despite increased demand from electrification.

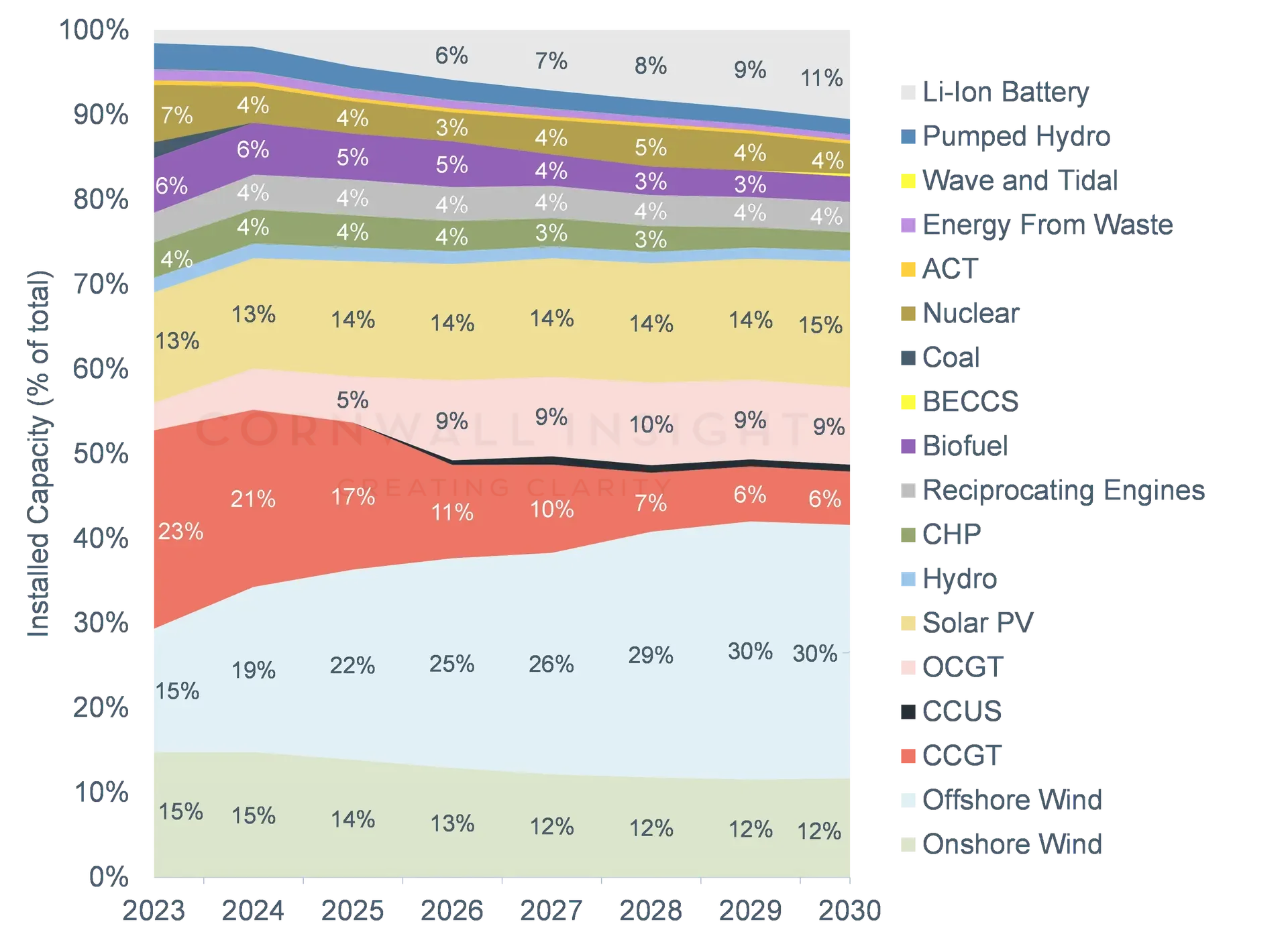

To aid in the UK net zero strategy, the government has invested heavily in renewables, setting itself a target of 50GW of offshore wind by the end of the decade. This investment is forecast to see offshore wind power double as a percentage of the UK electricity capacity by 2030, going from 15% to 30%.

As increased renewables capacity is added to the UK, and the electrification of economies increases, more of the UK’s energy is forecast to be exported to Europe; this coupled with higher gas prices means despite the levelling out of costs, forecast prices do not return to historic norms.

Recent announcements by the government, including a consultation on a cap on the excess profits of renewable generators, have unsettled the market, and investment may well decrease as investors take stock of their options, potentially slowing the drop in and levelling out of energy prices.

In the shorter term, the continued Russian gas supply uncertainly in the EU, exacerbated by prolonged outages of French nuclear capacity and low rainfall levels affecting Norwegian hydro, are continuing to add significant risk premiums to the gas forward curve, with increasing gas prices making periods of low renewable availability more expensive. Moving further through the decade an increase in battery storage capacity means renewable energy can be stored for use during periods of low wind and solar generation, lowering prices during these times.

Figure 1: Power price forecasts – average price per fiscal year

Source: Cornwall Insight Benchmark Power Curve

Figure 2: Future electricity generation capacity breakdown

Source: Cornwall Insight Benchmark Power Curve

Tom Edwards, Senior Modeller at Cornwall Insight said:

Over the past year, the energy market has moved into uncharted territory, as geopolitical concerns threaten supply and increase volatility across the global market. With Russian sourced energy no longer an option in large swaths of Europe, we are seeing first-hand the fallout from re-plumbing global gas supply.

A move towards low-carbon energy generation such as offshore wind, with its relatively low marginal costs, is the UK’s logical path away from an energy market suffering from supply-led high and unstable prices. As our forecasts show, offshore wind may be a significant catalyst in bringing about a drop in prices and a decrease in market volatility as we move through 2030.

To meet the offshore wind targets and reap the rewards of an increasingly renewables-led system, we will need to see continued, and ever-increasing, investment from both private sector and the government. To this end, it is important that the government take a moment to consider the implications of any short-term energy interventions. While quick injections of cash to an increasingly costly energy system may be welcomed, we must make sure this is not at the expense of renewable energy investment and consequently the longer-term security and stability of the UK energy market.

While increasing offshore wind, amongst other changes to the energy mix, have led to lower forecasts, it is important to recognise that prices could remain well above pre-pandemic levels until 2030 and beyond. Higher demand for renewables as gas becomes more difficult to procure, and the intensifying move towards electrification, will ultimately lead to prices stabilising at higher levels than previously predicted. However, we must not let perfection become the enemy of the good, pre-pandemic prices may not be within our grasp, but a lower cost and a stabilised energy market is achievable if we continue to invest in a low-carbon energy future.”

–Ends

More information: If you would like to find out more on our Benchmark Power Curve service please contact:

Tom Ross

Phone: +44 (0) 208 0169 159

Email: t.ross@cornwall-insight.com

You can also find out more on our website: Benchmark power curve

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.