"The announcement by the Prime Minister to delay the ban of petrol and diesel vehicles has compounded the challenges casting uncertainty over the UK's EV market. This threatens to erode the country's momentum in shifting away from traditional fossil fuel cars."

Jamie Maule Research Analyst

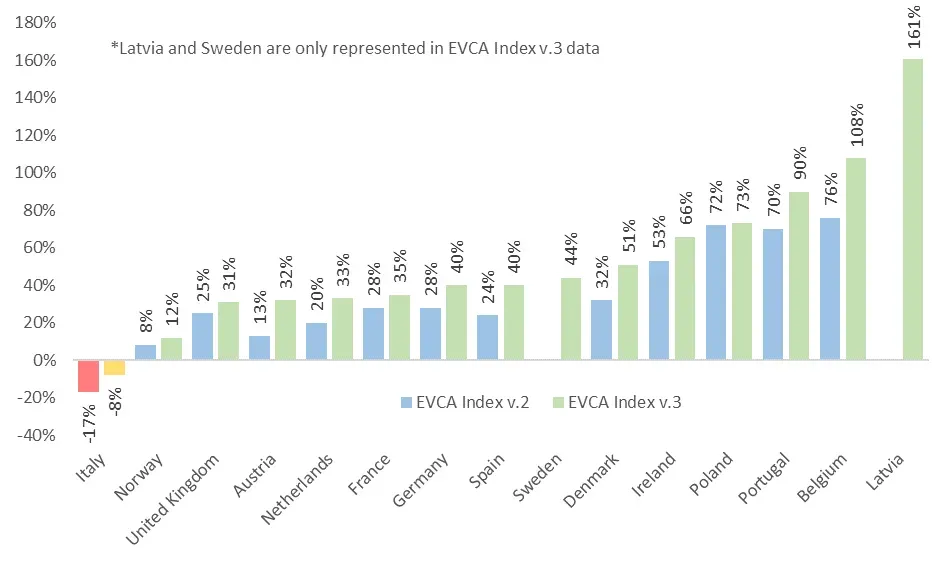

New analysis has revealed that Battery Electric Vehicle (BEV) growth in the UK is falling behind most of Europe, with growth just half of the continental average. This comes as a delay on the ban of new petrol and diesel car sales threatens to slow the BEV transition further.

The data, analysed for Cornwall Insight and law firm Shoosmiths’ Electric Vehicle Country Attractiveness (EVCA) Index1, shows that over the past year (July 22 – July 23) UK BEV sales growth was one of the slowest across the major European countries at only 31% compared to the impressive 60.6% growth seen across the 27 European Union nations.

The EVCA1, a quarterly ranking that charts the relative attractiveness of major European nations for investment in BEVs, found that ‘range anxiety’ and the lack of public charging infrastructure, with a ratio of 11.3 BEVs to every publicly accessible charge point in the UK, were contributing to slower growth.

Additionally, the index found cuts to BEV purchase incentives including the de-facto closure of the subsidy scheme to help with the purchase of passenger BEVs, known as the Plug-in Grant2, as well as the continued delays to the rollout of rapid charging across the UK’s motorways were slowing down BEV sales in the UK. Continued macroeconomic difficulties throughout the UK, with both high inflation and electricity prices, have only acted to compound these issues.

It is thought the Prime Minister’s announcement that the UK is to delay the ban on the sale of new petrol and diesel cars by five years (from 2030 to 2035) could further damage BEV sales growth. While still in alignment with many European nations, the watering down of BEV policy may lead to the UK’s transition losing some momentum and could potentially have an impact on both consumer and industry confidence.

Figure 1 – BEV sales growth, Q322 – Q223

Source: The European Automobile Manufacturers Association (ACEA)

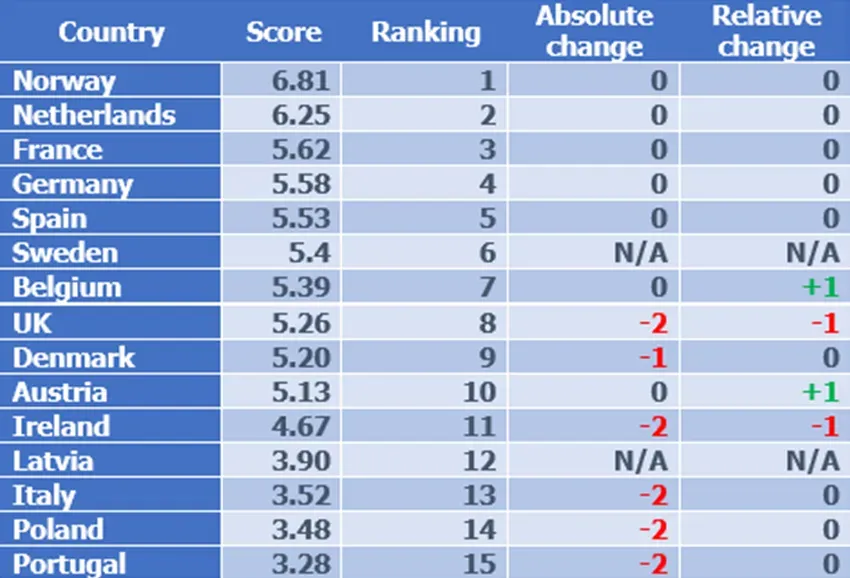

The roll-back of petrol and diesel phase-out targets, slow growth and the addition of Sweden, put the UK two places lower in the EVCA than three months ago, as Norway retains the top spot. Despite the reduction in the ranking, the country remains in a strong position as only slim margins separate it from the upper echelons of the index, with the third and eighth-ranked countries split by only ~0.4 points.

Figure 2: EV Country Attractiveness Index scores and rankings:

Source: Cornwall Insight and Shoosmiths

*Absolute change refers to the overall change in ranking while relative change tracks the change in ranking since the previous iteration of the index, without the inclusion of Sweden and Latvia.

Jamie Maule, Research Analyst at Cornwall Insight said**:**

Despite strong progress, the UK could now be at risk of falling behind much of Europe in the transition to Electric Vehicles. While we are still seeing growth, the removal of incentives, infrastructure delays and wider policy uncertainty remain significant hurdles for EV expansion in the UK.

The announcement by the Prime Minister to delay the ban of petrol and diesel vehicles has compounded the challenges casting uncertainty over the UK’s EV market. This threatens to erode the country’s momentum in shifting away from traditional fossil fuel cars.

Only by reaffirming our commitment to EV infrastructure growth, bolstering incentives, and rekindling investor and consumer confidence, can the UK reclaim lost ground and position itself among the leading nations in Europe for EV adoption.”

Chris Pritchett, Energy and Infrastructure Partner at Shoosmiths said:

OEMS and chargepoint operators are investing billions in the electric transition and progress has been rapid, but the government’s screeching U-turn on policy threatens new investment into the UK’s wider green industry, whether it’s vehicle production, battery and semi-conductors, lithium extraction or facilities to deal with end-of-life batteries. More importantly, it frames net zero as a political wedge issue ahead of the election which is clearly (and unforgivably) aimed at dividing the consensus on meaningful climate action.

I’m confident, though, that our business leaders in the sector will continue to set the pace on the EV transition, a rapidly converting public will join the ride, and this week’s frustrating setbacks will ultimately be nothing more than a bump in the road”.

Reference:

- The Electric Vehicle Country Attractiveness (EVCA) Index is a quarterly ranking that charts the relative attractiveness of major European nations for investment in EVs. A range of indicators, subject to differing weightings, have been utilised in the production of this index. They are listed as follows without regard to importance or weighted value:

- Committed government funding

- National EV sales targets

- National EV charge-point implementation targets

- Support for ICE vehicle rollback or ban

- Available investment subsidies, funds, and tax benefits for EVs and EV charge-points

- Available purchase subsidies, funds, and tax benefits for EVs and EV charge-points

- Ability to conduct business

- Rate of inflation

- Market share of BEVs

- Year-on-year growth of BEV sales

- Wholesale cost of electricity scaled to GDP

2. The Plug-in Grant subsidy scheme was closed to all passenger cars last June, except for those fitted with wheelchairs and plug-in taxis.

Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.

About Shoosmiths

Shoosmiths is a major law firm with a network of offices working together as one team. A key tenet of the firm’s strategy is its focus on five sectors – Mobility, Energy & Infrastructure, Technology, Living, and Financial Services. Electric vehicle (EV) charging infrastructure touches on all of these sectors and, as such, is an area of combined focus for the firm’s sector groups.

Shoosmiths’ national multi-disciplinary e-Mobility & infrastructure team has a proven track record supporting the EV sector. Their specialists advise companies involved throughout the sector from initial corporate fundraising and investment to project site selection (including real estate, commercial, planning and construction advice), to project operation and maintenance, to operational commercial offers for consumers and third-party access to charging infrastructure, to final divestment.