Cornwall Insight have reduced their short-term power market price forecast for Ireland, with predictions for 2024 dropping by over 18%. This could bring welcome relief to homes and businesses struggling with soaring energy costs.

Higher than anticipated gas storage levels in the EU have lowered fears of shortages this winter. With the surplus meaning less gas is required for summer refills, resulting in a welcome reduction in prices.

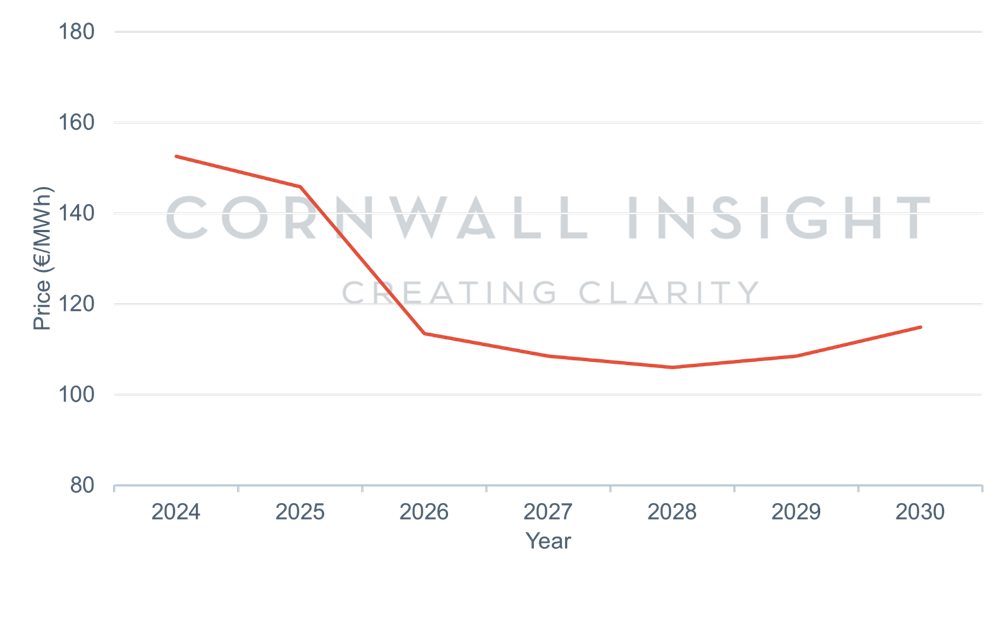

The data, included as part of Cornwall Insight’s fourth 2023 All-Island forward curve, represents a drop of over €34 per MWh1from the previous quarterly forecast.

Despite the fall, the impact of Europe’s increased reliance on Liquified Natural Gas shipments following the sanctions on imports from Russia, are expected to keep Irish prices above historic averages.

In the medium-term prices are predicted to continue to drop as Ireland works towards its ambitious 2030 target of 80% renewable energy, phasing out higher priced fossil fuel technologies for more cost-effective renewable generators.

However, power prices in Ireland are expected to rise again in 2029 due to higher demand from data centres and the shift to electric power in various sectors, alongside an increase in exports. These factors keep Irish prices notably above pre-2021 averages, extending to the end of the decade.

Figure 1: Power price forecasts – average price per fiscal year2

Source: Cornwall Insight’s All-Island Forward Curve

*Exact figures included in reference

Sarah Nolan, Senior Modeller at Cornwall Insight:

“With the EU’s boosted gas reserves cutting prices, it is hoped this will lead to a much needed reprieve for households and businesses who have been struggling with a cost of living crisis.

“While Irish energy prices will likely remain higher than pre-crisis levels for the foreseeable future, Ireland’s renewable ambitions are pushing towards a more stable and sustainable energy future. The energy landscape is changing, and while the road ahead may not be smooth, Ireland is firmly on the right track.

“We need continued investment in renewables, energy efficiency measures, and support for vulnerable households to ensure everyone benefits from Ireland’s energy transformation.”

Reference:

1.Q3 (Jul – Sept) forecasts for 2024: €186.62/MWh

Q4 (Oct-Dec) forecasts for 2024: €152.54/MWh

2. Power price forecasts (Q4) – average price per fiscal year (per €/MWh)

| 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| 152.54 | 145.86 | 113.54 | 108.57 | 106.09 | 108.55 | 114.92 |

Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

Want to keep up to date with Cornwall Insight’s price cap predictions? We have launched a dedicated webpage that will be regularly updated with our released predictions. This page also offers helpful answers to frequently asked questions about the price cap. Don’t miss out on this valuable resource – check out the page today: Predictions and Insights into the Default Tariff Cap

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.