In response to Ofgem’s announcement of a consultation on recovering bad debt, Dr Matthew Chadwick, Lead Research Analyst at Cornwall Insight said:

“The energy price crisis has left millions of households struggling to pay their bills, even as prices have begun to fall. With government support all but ended for the majority of consumers, and the Default Tariff Cap failing to provide much-needed relief, the situation seems destined to remain bleak.

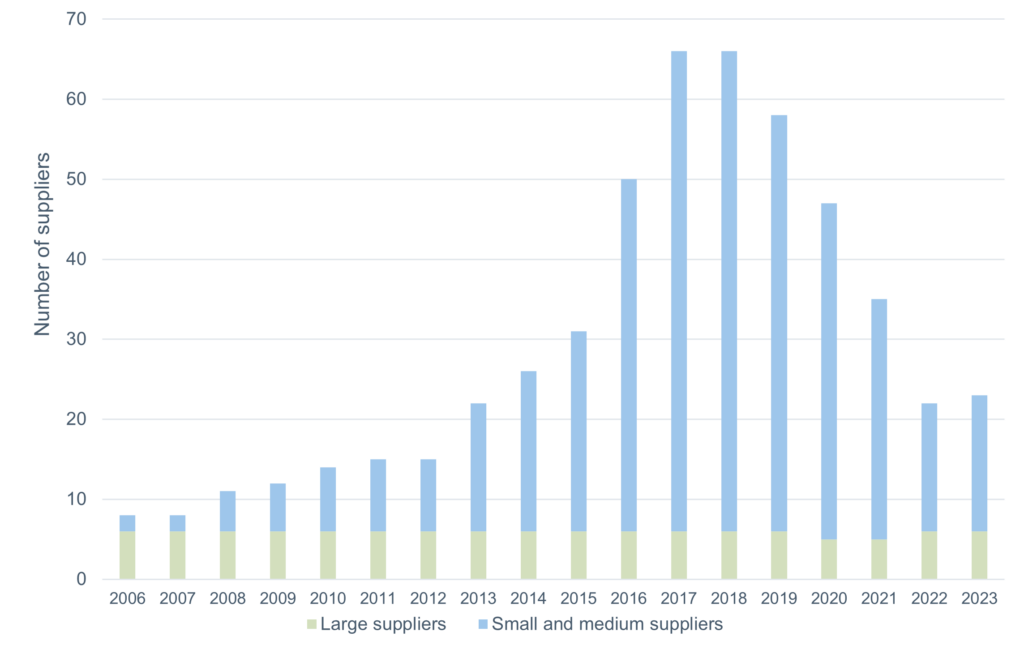

“The mounting weight of unpaid energy debts is a crushing burden for suppliers, many of whom are already operating on razor-thin margins. We currently have 241 fewer domestic suppliers in the market than November 2020. The costs for failed suppliers ultimately fall on the shoulders of those paying their energy bills. Without intervention, suppliers and consumers could be trapped in a vicious cycle of rising bills, mounting debts, supplier failures, and even higher bills.

“The question of how to recover these debts without saddling struggling consumers with even higher bills is not easy. Ofgem acknowledges that targeting only the vulnerable for debt repayment is both unfair and impractical. On the flip side, their blanket proposal to raise bills by £16 per year for all non-prepayment customers could be seen as placing the burden on everyone, regardless of their ability to pay.

“To safeguard suppliers from collapse without increasing fuel poverty and bad debt, urgent consideration of effective measures, such as social tariffs, to support the most vulnerable in paying their energy bills, is essential.”

Figure 1: Number of domestic suppliers active in the market

Source: Cornwall Insight Domestic Supplier Insight Service

Reference:

- Cornwall Insight Domestic Supplier Insight Service:

November 2020: 47 domestic suppliers

November 2023: 23 domestic suppliers

- Ends

Notes to Editors

For more information, please contact: Verity Sinclair at v.sinclair@cornwall-insight.com

To link to our website, please use: https://www.cornwall-insight.com/

Copyright disclaimer for commercial use of the press releases:

The content of the press release, including but not limited to text, data, images, and graphics, is the sole property of Cornwall Insight and is protected by UK copyright law. Any redistribution or reproduction of part or all of the content in any form for commercial use is prohibited without the prior written consent of Cornwall Insight.

Media Use Exemption:

The information included in this press release may be used by members of the media for news reporting purposes only. Any other commercial use of this information is prohibited without the prior written consent of Cornwall Insight.

All non-media use is prohibited, including redistribution, reproduction, or modification of our content in any form for commercial purposes, and requires prior written consent. Please contact: enquiries@cornwall-insight.com

Want to keep up to date with Cornwall Insight’s price cap predictions? We have launched a dedicated webpage that will be regularly updated with our released predictions. This page also offers helpful answers to frequently asked questions about the price cap. Don’t miss out on this valuable resource – check out the page today: Predictions and Insights into the Default Tariff Cap

About the Cornwall Insight Group

Cornwall Insight is the pre-eminent provider of research, analysis, consulting and training to businesses and stakeholders engaged in the Australian, Great British, and Irish energy markets. To support our customers, we leverage a powerful combination of analytical capability, a detailed appreciation of regulation codes and policy frameworks, and a practical understanding of how markets function.