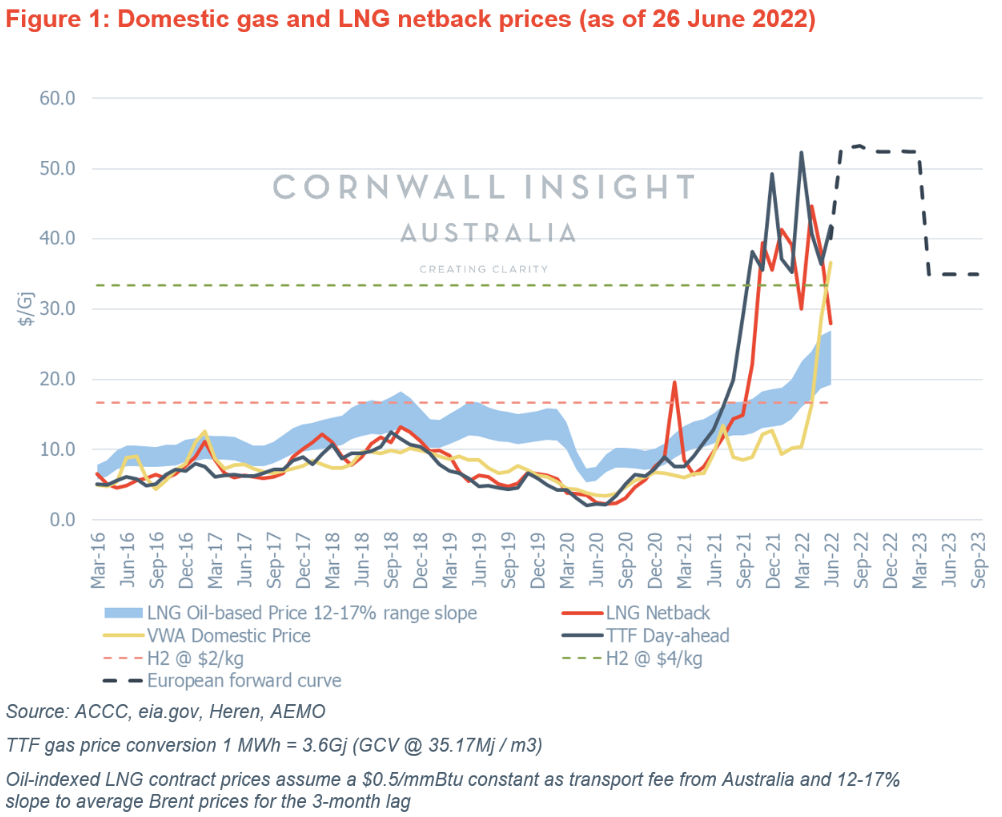

Last year it was difficult to imagine that spot gas prices in Australia would hit unprecedented levels of more than $40-50/GJ, with AEMO capping the DWGM price at $40/GJ. By comparison, the DWGM only averaged $5.10/GJ last year. As was mentioned by Energy Market Intelligence Manager Mohsin Ali in the previous COTW issue #136, price spikes like this have occurred in the past, usually lasting a day or two before setting back to normal levels ($5-$12/GJ). Conversely, the current price spike has been sustained for weeks, which has never been seen before in the gas wholesale market. It seems that global gas prices, TTF (Europe) and JKM (Asia), currently play an important role in influencing gas prices in the east coast gas market for several reasons:

- Gas supply issues, curtailed gas flows (by~40%) from Russia to the EU

- EU storage restocking requirements ahead of winter 2023

- Stronger than anticipated gas demand recovery in the post-Covid world

- Limited LNG flexibility due to planned and unplanned outages globally

In this Chart of the week, we examine the fundamental drivers that have traditionally driven gas prices in Australia, whether new fundamentals have arisen, and what this could mean for energy markets in Australia going forward.

JKM prices (Asian LNG spot prices) have traditionally heavily influenced Australian gas spot prices. As seen in Figure 1, stronger JKM prices, which have been supported by European spot prices (a new driver of JKM prices), have pushed Australian LNG netback prices higher, subsequently pushing up DWGM gas prices.

European overview

European gas prices started to rise at the beginning of last year and hit all-time highs with an annual average of $22.5/GJ ($15.8/mmBtu). Strong demand recovery (up 5.5%) together with plummeting domestic production (down 10%), lower LNG inflows (down 4%) and reduced Russian pipeline deliveries to the European Union (down 3%) resulted in a tight gas market. As Europe is trying to diversify its gas supplies from Russia, and attract alternative supplies (e.g. LNG), we might see a fundamental shift whereby Europe’s role in the LNG market changes from being a global sink for LNG oversupply (seen in 2019-20) to a direct competitor with Asian gas markets, leading to a much closer correlation between the two markets in the medium term. Currently, LNG accounts only for ~19% of Europe’s total gas supply, with the US being the largest supplier in 2021.

Adding pressure to gas supplies was a fire on 8 June at Freeport LNG’s facility in Texas, which has reduced U.S. export capacity by one-sixth.

Most of Freeport’s exports were contracted by Japanese buyers, with the majority of volumes being redirected to Europe as TTF is at a premium to Asian markets. The missing volumes from Freeport LNG will increase Europe’s appetite for uncontracted spot cargoes, leading to increased competition for volumes with Asia and providing further pressure to gas prices in the short term. Currently, Freeport LNG is not expected to return to full plant operations until late 2022.

Forward outlook

European gas futures are currently trading at $45/GJ, suggesting that tight fundamentals (e.g. reduced LNG and gas imports from Russia) will persist into 2023. Spot outturn gas prices in Europe are likely to hover around that level in 2023 if Germany and other EU states do not manage to re-fill their gas storage ahead of the heating season (which starts in October). This would then subsequently create additional gas demand to satisfy increased storage injections next summer, likely keeping prices high. In addition to the European tight supply-demand balance projected for winter 2023, it will be interesting to see if China’s strong appetite for LNG will continue in 2023 or whether this may be satisfied through increased pipeline flow from Russia across the Power of Siberia pipeline. If winter in China sees extended periods of below-average temperatures, it is very likely that JKM prices will remain relatively strong, adding upward pressure to LNG netback and Australian domestic gas prices.

Extraordinary high gas and power prices have negatively affected domestic end-users, utilities and retailers who are now competing against other buyers desperate for more supply. Hence, the ‘opportunity cost’ for gas is extremely high, meaning whoever has a gas supply contract could make more money by re-selling it to someone else. We will be keeping a close eye on the outcomes over the short term, particularly watching how Russian gas flows into Europe will evolve during Q3-Q4 2022 and how quickly Germany and other EU states will be able to re-fill gas storage facilities ahead of new Gas Year starting on 1 October 2022.

If you are interested in understanding the impacts of these potential market dynamics on future price curves, please reach out to our team, who will be releasing our updated price curves (Benchmark Power Curve) in the next few weeks. For more information, please email enquiries@cornwall-insight.com.au.